Who sends the 1099 s to the seller?

Form 1099-S is used to report the sale or exchange of present or future interests in real estate. It is generally filed by the person responsible for closing the transaction, but depending on the circumstances it might also be filed by the mortgage lender or a broker for one side or other in the transaction.

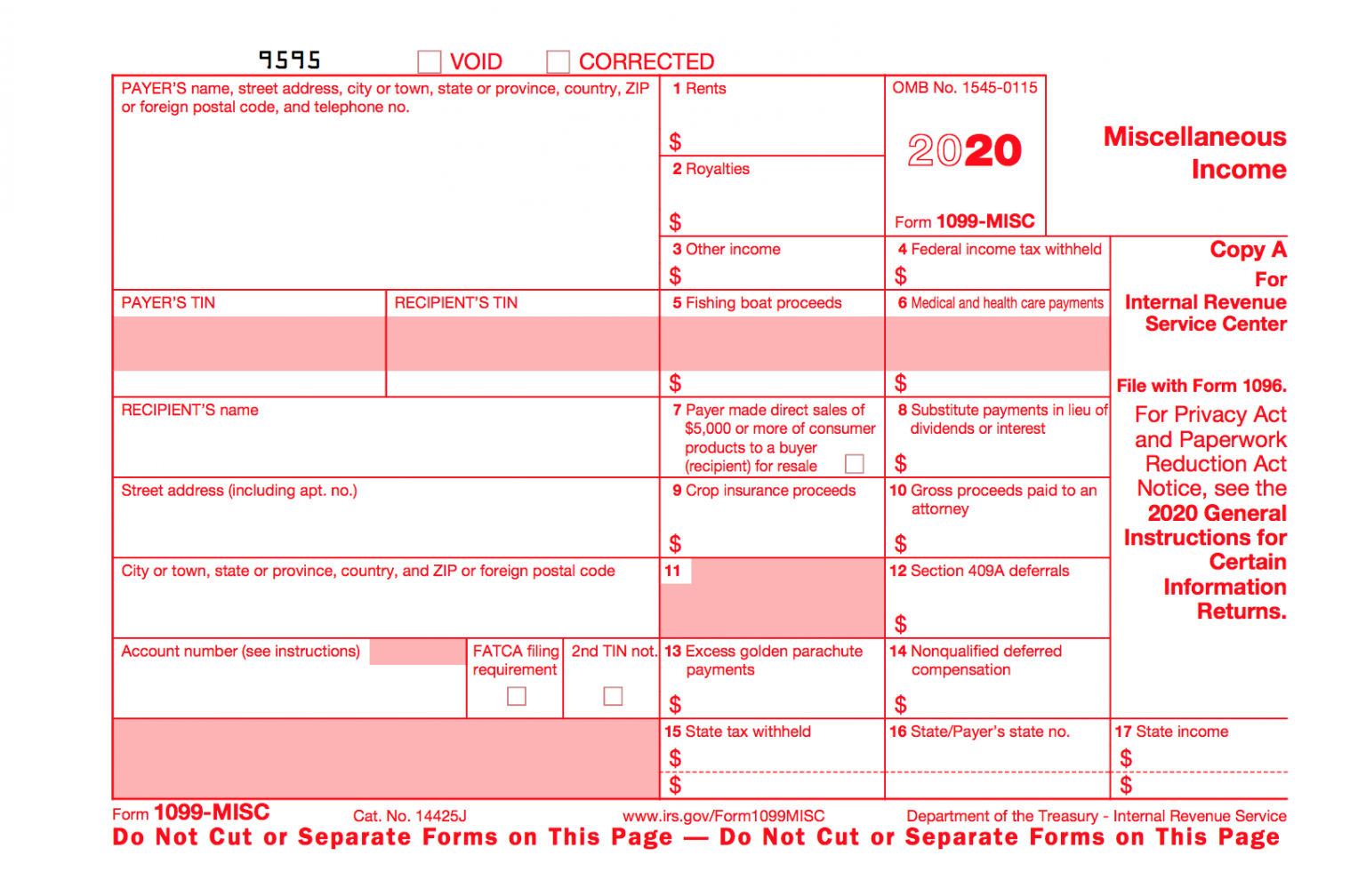

Do real estate agents get 1099 NEC or 1099-MISC?

Brokers must issue a Form 1099-MISC to real estate agents who received payments of at least $600 in the corresponding tax year. “MISC” stands for “miscellaneous” reporting and is necessary for filing tax returns and determining how much tax an independent contractor owes.

Where do 1099s get sent?

When must brokers issue 1099s?

If you sell stocks, bonds, derivatives or other securities through a broker, you can expect to receive one or more copies of Form 1099-B in January. This form is used to report gains or losses from such transactions in the preceding year.

How do I list business expenses on my taxes?

Business expenses can be categorized into various buckets including payroll, employee benefits, general and administrative expenses, marketing and advertising, research and development, and payments for professional services.

Which of the following is a fully deductible business expense for a real estate broker?

Both general business insurance and Errors & Omissions (E&O) insurance are fully deductible as an IRS real estate agent tax deduction. While you may not deduct self-employment taxes from your taxable income, you may deduct real estate taxes that are necessary for your business.

Frequently Asked Questions

What type of business expenses are tax-deductible?

- Business Meals. As a small business, you can deduct 50 percent of food and drink purchases that qualify.

- Work-Related Travel Expenses.

- Work-Related Car Use.

- Business Insurance.

- Home Office Expenses.

- Office Supplies.

- Phone and Internet Expenses.

- Business Interest and Bank Fees.

How do I maximize my real estate tax deductions?

How can high earners reduce taxable income in real estate?

If you own a home with a mortgage, you can deduct the interest paid. Deductions are also allowed for state and local taxes on the property. Deducting these expenses might not make a huge difference to your tax bill but every penny counts for reducing your taxable income.

What type of expense is headshots?

On this form, the taxpayer would be able to include headshots (photographers fees and duplication costs) and marketing photos on the "Other Expenses" section of the Schedule C of the 1040 form.

How do you categorize photography expenses?

- Advertising.

- Business Travel.

- Meals and Entertainment.

- Commissions.

- Communication.

- Contract Labor.

- Legal and Professional Fees.

- Insurance Payments.

Can realtors write off haircuts?

Real estate agents are eligible for a wide variety of tax deductions. Expenses such as client entertainment, personal wardrobe, and haircuts aren't deductible.

FAQ

- Can I write off headshots on taxes?

Any equipment you use to shoot promotional tapes, portraits, and more can be written off. Getting professional headshots done to book acting and model gigs can be written off. If you belong to a union, go ahead and write off your dues. Squarespace, Wix, GoDaddy, and other website service fees are fully tax-deductible.

- Can you write-off lead generation fees?

- Tickets and entry fees to networking events to grow your client base can be written off. Software for CRM, lead generation, or email marketing is a write-off. Write off any email marketing software like Mailchimp or ActiveCampaign.

- Can realtors write-off marketing expenses?

- Property marketing Expenses related to advertising like marketing materials, signs, photography, and staging are all deductible through the advertising expense deduction. The broad requirements of this deduction make it an especially valuable tax deduction for realtors.

- What is a new lead in real estate?

Real estate leads are people who are looking at property and might be interested in hearing a pitch from you. You might call a lead a “future client.” If everything goes well, then you'll likely close the deal. In between getting a lead and closing a deal, you need to nurture the lead.

- What is a real estate expense?

These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs. You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business.

- Is buying leads a business expense?

In general, the tax deductibility of sales leads purchased for business purposes may depend on a variety of factors, such as the type of business, the purpose of the lead data enrichment, and the laws of the relevant jurisdiction.

Where do real estate brokers from illinois get their 1099s

| Does buying real estate count as an expense? | As a newly minted homeowner, you may be wondering if there's a tax deduction for buying a house. Unfortunately, most of the expenses you paid when buying your home are not deductible in the year of purchase. The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points). |

| Can you write off a real estate investment? | Rental property owners can deduct the costs of owning, maintaining, and operating the property. Only the value of the buildings can be depreciated. You can't depreciate the land since it never gets "used up." The tax treatment of income and losses depends on your level of involvement in the rental property. |

| Are home sale expenses tax deductible? | When you sell an investment or rental property, you may be able to deduct certain selling expenses from your taxes. These deductible selling expenses can include advertising, broker fees, legal fees, and repairs made as part of the home sale. To deduct these expenses, itemize them on your tax return. |

| Can you write off the purchase of a building? | The IRS permits owners to depreciate commercial buildings over a 39-year period and residential buildings over a 27.5-year period. For instance, if an investor purchases a $5 million commercial building, they can take approximately $128,000 of depreciation each year. |

| Are licensing fees tax-deductible? | All state, local, and foreign taxes paid or accrued in connection with trade or business or production of income are deductible. In addition, annual fees paid to keep a business license current are deductible as an ordinary and necessary business expense. |

| Are talent agent fees tax-deductible? | Any kind of fee associated with the business side of being an actor can be deducted. This included your agent and manager fees, the cost of hiring a CPA (certified personal accountant), SAG or AEA union dues and yearly subscriptions like Casting Networks or your website. |

- What is a real estate professional IRS?

To qualify as a real estate professional, a taxpayer must satisfy the following tests: 5. Perform more than 50% of services in real property trades or businesses (“50% test”), and. Perform more than 750 hours of service in real property trades or businesses (“750 hours test”), and.

- How are licensing fees taxed?

The main tax difference between a license and a sale transaction is that license payments are taxed as ordinary income and sale proceeds are taxed as capital gains.

- How do I keep track of realtor expenses?

One effective way to achieve this is through a real estate agent expense spreadsheet. A well-organized spreadsheet can help professionals keep track of all their expenditures, enabling them to make informed decisions about their business operations and spending habits.

- Can realtors write off marketing expenses?

- Property marketing Expenses related to advertising like marketing materials, signs, photography, and staging are all deductible through the advertising expense deduction. The broad requirements of this deduction make it an especially valuable tax deduction for realtors.

- Is real estate commission an expense?

FAQ about real estate commissions

Real estate agents get paid from a percentage of a home sale, typically at a rate of 2-3% each for the buyer's and seller's agents. That means on a traditional home sale, 4-6% of the home sale price goes to agent fees. This expense is part of seller's closing costs.

- What accounting method do realtors use?

Cash basis method

For example, many realtors file their taxes using the cash basis method of accounting. For these agents, revenue is recognized when it is constructively received. In other words, income is usually recognized when a direct deposit hits your bank account or when you have a check in your hand.

Recent Comments