What if my mortgage company is not paying taxes?

First, don't panic, but do take immediate action. Start by contacting your lender, tax authority, and even your lawyer if necessary. Getting an unpaid tax notice in the mail can be scary, especially when you know you have an escrow account and your mortgage payments are up to date.

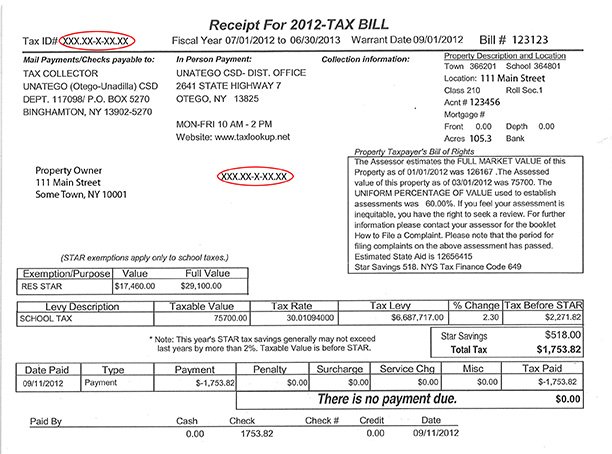

How do I get a copy of my property tax bill in NY?

You can always download and print a copy of your Property Tax Bill on this web site. If you lost the original bill, and are making a payment, you can pay electronically or print out and send in the online copy with your tax payment. You do not need to request a duplicate bill.

How do I find my property tax bill online in Indiana?

How do you know if your taxes are paid in escrow?

Are most real estate agents employees or independent contractors?

In the real estate industry in the United States, real estate agents, while under the supervision of real estate brokers, are not generally considered employees unless this employer/employee has been expressly stated. Instead, in most cases, real estate agents are considered independent contractors.

Understand your local real estate market:

— Andrew Lokenauth | TheFinanceNewsletter.com (@FluentInFinance) June 21, 2023

To be a great rental property investor, you need to have a thorough understanding of your local real estate market, including the current trends, the demographics of the area, and the types of properties that are in demand.

What percentage do most real estate agents get?

While realtor commission fees vary regionally, the average seller can expect to pay between 4.45% to 6.34% of the home's final sale price, according to our research. The U.S. average is currently 5.37%. The listing agent usually receives 2.72% of the proceeds.

Frequently Asked Questions

What industry has the most independent contractors?

- Computer & IT.

- Administrative.

- Accounting & Finance.

- Customer Service.

- Software Development.

- Medical & Health.

- Project Management.

- Research Analyst.

What do I need before investing in real estate?

- Property Location.

- Valuation of the Property.

- Investment Purpose and Investment Horizon.

- Expected Cash Flows and Profit Opportunities.

- Be Careful with Leverage.

- New Construction vs. Existing Property.

- Indirect Investments in Real Estate.

- Your Credit Score.

How does a beginner invest in real estate?

What is a good reason to invest in real estate?

On its own, real estate offers cash flow, tax breaks, equity building, competitive risk-adjusted returns, and a hedge against inflation. Real estate can also enhance a portfolio by lowering volatility through diversification, whether you invest in physical properties or REITs.

What is the most important for real estate agent?

- Knowledge is power.

- Build a network of connections.

- Understand the local housing market.

- Attention to detail.

- Engaging personality.

- Interest in houses and architecture.

- Hustle and tenacity.

- Honesty and integrity.

What are the pros and cons of investing in real estate?

There are a number of advantages to investing in real estate, including recurring income, appreciation in property value over the long term, and a wide variety of tax benefits. However, real estate is also capital- and management-intensive and can't quickly be sold.

How do you successfully invest in real estate?

- Make a Plan.

- Know the Market.

- Be Honest.

- Develop a Niche.

- Encourage Referrals.

- Stay Educated.

- Understand the Risks.

- Invest in an Accountant.

Who are the best real estate investors?

- Donald Bren. Net Worth. In the first quarter of 2021, Donald Leroy Bren's net worth was $12.4 billion.

- Stephen Ross. Net Worth.

- Sun Hongbin. Net Worth.

- Leonard Stern. Net Worth.

- Neil Bluhm. Net Worth.

- Igor Olenicoff. Net Worth.

- Jeff Greene. Net Worth.

- Sam Zell. Net Worth.

Why you should use a local realtor?

They care about the well-being of the area and work to help it thrive. In conclusion, working with a local realtor offers many benefits, including in-depth knowledge of the local market, personalized service, local connections and networks, accessibility and availability, and support for the local economy.

Why do most millionaires invest in real estate?

Because of the many tax benefits, real estate investors often end up paying less taxes overall even as they are bringing in more income. This is why many millionaires invest in real estate. Not only does it make you money, but it allows you to keep a lot more of the money you make.

What are the characteristics of a really good real estate investor?

- Good money management skills. Most successful property investors are good money managers.

- Good analytical skills.

- Laser focus.

- The ability to develop a solid network.

- Being a good negotiator.

- Long-term thinking.

- Knowing how to be patient.

Who is considered the best investor?

Warren Buffett

Warren Buffett is widely considered the greatest investor in the world. Born in 1930 in Omaha, Nebraska, Buffett began investing at a young age and became the chairman and CEO of Berkshire Hathaway, one of the world's largest and most successful investment firms.How do agents work with investors?

An investor client may have some tasks in mind that are quite different than your traditional role. He may want to handle offers and have you strictly handling paperwork. He may want your broker's license to handle renting and leasing. He may just want you as a consultant—especially if he's a new investor.

Why do investors choose real estate?

Real estate investors make money through rental income, appreciation, and profits generated by business activities that depend on the property. The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage.

What do investors do in real estate?

Real estate investing involves the purchase, management and sale or rental of real estate for profit. Someone who actively or passively invests in real estate is called a real estate entrepreneur or a real estate investor. Some investors actively develop, improve or renovate properties to make more money from them.

What is an agent's role in locating properties for an investor?

Investor-friendly agents often have existing relationships with wholesalers who are looking for homeowners willing to sell for cash. The agents then bring those available properties to their investor clients before they are listed, eliminating the need to bid against other buyers.

How does an investor get paid from real estate?

Key Takeaways. The most common way to make money in real estate is through appreciation—an increase in the property's value that is realized when you sell. Location, development, and improvements are the primary ways that residential and commercial real estate can appreciate in value.

FAQ

- What are 3 ways real estate investors make money?

- Let's dive in and see how you, too, can become a lucrative real estate investor.

- Leverage Appreciating Value. Most real estate appreciates over time.

- Buy And Hold Real Estate For Rent.

- Flip A House.

- Purchase Turnkey Properties.

- Invest In Real Estate.

- Make The Most Of Inflation.

- Refinance Your Mortgage.

- What is the role of real estate investor?

Hear this out loudPauseYou buy and sell properties, manipulate their valuation, collect rents, and lobby politicians and governmental land-use agencies to realize a profit. You may work alone as an individual investor, with a partner, or as part of a network of investors.

- In which situation is the broker not entitled to a commission?

- A broker who first finds or contacts the purchaser or tenant, but who abandons the transaction is not entitled to a commission just because a subsequent broker then successfully brings together the owner and buyer or tenant.

- Which clause allows a broker to sue for a commission?

Safety protection clause

A safety protection clause entitles a real estate broker to a commission if a sale occurs after the listing agreement expires. This protects the broker from collusion between sellers and buyers to save the seller the cost of real estate commission.

- What happens if seller doesn't pay commission?

If you've already signed a purchase agreement and then refuse to honor the agreed-upon commission, you'll be in breach of contract. At this point, you may face legal consequences, as the aggrieved broker can take legal action against you for damages, or payment of the commission as required under the contract.

- Does withdrawal from sale clause entitles a broker to be paid a full listing fee?

A withdrawal-from-sale clause entitles a broker to be paid a full listing fee if, during the listing period, the owner's conduct causes the property to be: withdrawn from the market, transferred to others, and made unmarketable.

- What is the most common complaint about brokers from sellers?

- Conflict of Interest

The Real Estate License Law prohibits brokers in a transaction from acting for more than one party without the knowledge of all parties for whom the broker acts. The most common complaints deal with dual agency, seller subagency, and special relationships between the parties.

- What is the most common complaint filed against realtors?

Breach of duty

One of the most common complaints filed against real estate agents revolves around the concept of breach of duty. In this blog, we'll delve into what breach of duty entails, provide examples of actions that could lead to such breaches, and emphasize the potential legal ramifications agents may face.

- What is the lowest a REALTOR can charge?

If the transaction is being handled on both sides by agents from the same brokerage, you might have more leverage as well. Alternatively, you could consider working with a low-commission real estate agent, who will likely charge less than a traditional agent would (usually 1 to 1.5 percent of your home's sale price).

- Is a buyer usually pays a real estate agent a commission True or false?

In exchange for their work, agents receive a percentage of the sales price known as the commission. Though it's the seller who is usually on the hook for the commission, the cost is generally factored into the listing price of the home. In this way, the buyer ultimately bears the cost of any real estate fees.

- Is it okay for a broker to negotiate co operating commission payments?

This Standard of Practice never prohibits negotiations between the listing broker and a cooperating broker at any time during the transaction.

- What is an ethical violation in real estate?

Real Estate and Ethical Standards

Real estate professionals must abide by ethical standards to avoid discrimination in real estate transactions. For example, a real estate agent that puts the wrong facts on a listing is acting unethically. Intentionally misstating a material fact regarding a property is fraud.

- Is a real estate investor the same as agent?

A real estate agent works in the real estate industry. He or she doesn't deal with the actual properties; only real estate transactions. A real estate investor, on the other hand, is someone who earns a living by buying investment properties and using them to gain money over the long haul.

- What is important to real estate investors?

- Becoming knowledgeable and educated about the real estate market is crucial, but this often comes with more than just in-class learning. Understanding the risks, investing in an accountant, finding help, and building a network are all part and parcel to the successful real estate investor.

- What is the most important skill of real estate investor?

Negotiation

A critical skill each real estate investor should have is the ability to see every investment opportunity beyond its current monetary value. Do not rush to finalize a deal because of its cost. Instead, conduct in-depth research on the property to make a wise investment.

- What do real estate investors call themselves?

Someone who actively or passively invests in real estate is called a real estate entrepreneur or a real estate investor. Some investors actively develop, improve or renovate properties to make more money from them.

- Why do people want to invest in real estate?

Real estate investors make money through rental income, appreciation, and profits generated by business activities that depend on the property. The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage.

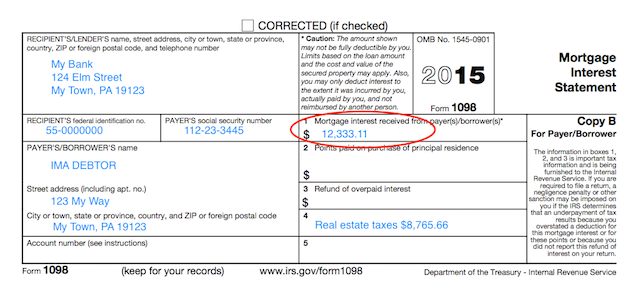

Where can i find the amount my lender paid in real estate taxes

| What are three main reasons to invest in real estate quizlet? | As such, it offers opportunities for large and small investors to purchase property with borrowed money and with minimum risk to their own capital. The major purposes of investing in real estate are to: (1) preserve capital, (2) earn a profit and (3) obtain tax shelter. |

| Which of the following is not considered a benefit in investing in real estate? | Expert-Verified Answer. The Answer is Realizing a quick profit. (Option-c). Investing in real estate can offer multiple benefits, but realizing a quick profit is not one of them. |

| Which is a benefit of investing in real estate quizlet? | The possibility of a tax-deferred exchange, the use of leverage to increase rates of return, and tax deductions are all advantages of an investment in real estate. |

| What are the advantages and disadvantages of investing in real estate? | There are a number of advantages to investing in real estate, including recurring income, appreciation in property value over the long term, and a wide variety of tax benefits. However, real estate is also capital- and management-intensive and can't quickly be sold. |

| What commission do most realtors charge? | Typically, real estate commission is 5%–6% of the home's sale price. In most areas, the buyer's agent receives 2.5%–3% in commission and the seller's agent receives 2.5%-3% in commission. This can vary by agent and location. |

| What percentage do most realtors charge Illinois? | 5.24% Typical Realtor Commission Rates in Illinois Across Illinois, the statewide average real estate commission on a home sale is 5.24% of the final sale price. |

| Is real estate commission an expense? | FAQ about real estate commissions Real estate agents get paid from a percentage of a home sale, typically at a rate of 2-3% each for the buyer's and seller's agents. That means on a traditional home sale, 4-6% of the home sale price goes to agent fees. This expense is part of seller's closing costs. |

| What does commission pay mean in real estate? | Real Estate Commission Most real estate agents make money through commissions that are based on a percentage of a property's selling price, (Commission can also be flat fees, but that is much less common.) Agents work under real estate brokers, and the commissions are paid directly to the brokers. |

| What percentage of sales do most realtors make? | While realtor commission fees vary regionally, the average seller can expect to pay between 4.45% to 6.34% of the home's final sale price, according to our research. The U.S. average is currently 5.37%. The listing agent usually receives 2.72% of the proceeds. |

| What is the purpose of an investment broker? | An investment broker is a financial professional that makes investment transactions for a client. These professionals can buy and sell securities, such as stocks, bonds, mutual funds and other investment products on your behalf. |

| Is it worth having an investment broker? | If you're getting started in investing, an investment broker can be a great asset as your connection to the market. Investment brokers serve as go-betweens for buyers and sellers on the stock market. They enable their clients to purchase stocks, bonds and other securities from the exchanges. |

| What is the primary function of the real estate brokerage industry? | A real estate broker is a professional with a state real estate broker license who helps buy, sell and transfer property. They use their expertise and knowledge of the real estate industry to assist clients with paperwork, decision-making and legal compliance. |

| What are the benefits of a real estate investor? |

|

| How do investment brokers get paid? | A broker or agent charges a brokerage fee to execute transactions or provide specialized services. Brokerage fees are based on a percentage of the transaction, as a flat fee, or as a hybrid of the two, and vary according to the industry and type of broker. |

| Do real estate agents pay B&O tax in Washington state? | Real estate commissions are subject to B&O tax on the full amount of the commission at the time of receipt by the brokerage office. Where broker is entitled to a nonrefundable monthly payment from agents regardless of whether commissions are earned by the agents, the income is subject to B&O tax. |

| How does a salesperson pay taxes on commissions earned? | An individual who receives commissions can be treated in the same manner as an individual who receives a straight salary. In that case, the employer would withhold taxes from the individual's compensation and remit the amount to the tax authorities on the individual's behalf. |

| Can a real estate agent form an LLC in Texas? | Yes, the Texas Real Estate Commission (TREC) allows real estate agents to use an entity like a limited liability company (LLC) as a business structure. |

- Who is a real estate professional by the IRS?

A taxpayer qualifies as a real estate professional for any year the taxpayer meets both of the following requirements: (1) more than half of the personal services performed in all trades or businesses during the tax year were performed in real property trades or businesses in which the taxpayer materially participated;

- Who is responsible for paying Washington's real estate excise tax?

The seller of

The seller of the property typically pays the real estate excise tax, although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property. REET also applies to transfers of controlling interest (50% or more) in entities that own real property in the state.

- Do I pay taxes if I have a mortgage?

- Property tax is included in most mortgage payments (along with the principal, interest and homeowners insurance). So if you make your monthly mortgage payments on time, then you're probably already paying your property taxes!

- Are property taxes included in mortgage Texas?

- Property taxes will be listed on your mortgage statements if you have an escrow account for homeowners' insurance and Texas property taxes. If your Texas taxes are not included in your mortgage, then you do not have an escrow account through your lender.

- Can I remove escrow from my mortgage?

To have your escrow account removed from your mortgage, you'll likely need: Less than 80% LTV on a conventional loan (no more than 90% LTV for a VA loan) No delinquencies within the last year and – depending on your investor – no 60-day delinquencies within the last 2 years. No loan modifications.

- What does escrow pay for?

When you make your total monthly payment, part of it goes toward your mortgage to pay your principal and interest, and another part goes into your escrow account to pay your taxes, homeowners insurance, and other expenses you might have when owning a home, like mortgage insurance and flood insurance.

- How does a mortgage affect your taxes?

The mortgage interest deduction is a tax incentive for homeowners. This itemized deduction allows homeowners to subtract mortgage interest from their taxable income, lowering the amount of taxes they owe.

- What not to tell a real estate agent?

- Here are the 7 most important things to not tell your realtor when selling.

- What you think your home is worth.

- Your need to sell quickly.

- Plans for upgrades before selling.

- Non-mandatory legal information about your property.

- You're okay with an inflated history of dual agency.

- Your lowest acceptable selling price.

- Here are the 7 most important things to not tell your realtor when selling.

- Is it normal for realtor to ask for proof of funds?

When you're buying a house, a proof of funds letter is a document that proves that a home buyer has enough liquid cash to purchase a home. It's essential paperwork that all home sellers will want to see, so home buyers shouldn't feel prepared to make an offer without one.

- Why do realtors ask for bank statements?

It's part of the qualifying process to see your ability to get a mortgage. The statements should show that there is enough funds for downpayment, closing costs and any reserves left back after closing. They usually show your monthly or weekly deposits from employment and a record of not bouncing checks written by you.

- What do most realtors make their first year?

As of Oct 23, 2023, the average annual pay for a First Year Real Estate Agent in California is $84,380 a year. Just in case you need a simple salary calculator, that works out to be approximately $40.57 an hour. This is the equivalent of $1,622/week or $7,031/month.

- What scares a real estate agent the most?

- How Real Estate Agents Can Overcome Fear and Self-doubt

- Talking to New People. Some real estate agents have a knack for connecting with strangers; others experience anxiety and dread every time they make a cold call.

- Fear of Rejection.

- Empty Open Houses.

- Unfair Criticism.

- Being Too Busy.

- How Real Estate Agents Can Overcome Fear and Self-doubt

- Which is not an advantage of investing in real estate?

Which is NOT an advantage of investing in real estate? Property lacks liquidity. Property is not always easy to sell in a quick fashion so if the market isn't right for sale or the property hasn't appreciated enough, the investor may not be able to sell as fast and at the price he seeks.

- What is a disadvantage of real estate investment quizlet?

Disadvantages of investing in real estate include the following: illiquidity, local market, need for expert help, management requirements, and risk.

- What are 3 advantages of investing in real estate?

The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage.

- What is one of the main disadvantages of investing in real estate?

Real estate investments tend to have high transactional costs, especially in legal and brokerage fees. The process of acquiring a new property is also very long and tedious with lots of legal formalities. Another disadvantage of property investments is that they are not easy to liquidate.

- What are the disadvantages of a real estate investment trust?

- Cons of REITs

- Dividend Taxes. REIT dividends can be a great source of passive income, but the money you receive is subject to your ordinary income tax rate, which will depend on your tax bracket.

- Interest Rate Risk.

- Market Volatility.

- You Have Little Control.

- Some Charge High Fees.

- Cons of REITs

Recent Comments