If the application is granted, the applicant will be paid an amount for his or her actual and direct (out of pocket) loss in a transaction, up to a statutory maximum of $50,000 per transaction, with a possible total aggregate maximum of $250,000 per licensee.

What is some of the money for the real estate Recovery fund is obtained from?

The Consumer Recovery Fund is fully funded through a portion of real estate agent licensing fees.

What is the pa real estate Recovery Act?

The Pennsylvania Real Estate License and Registration Act

The fund exists to compensate people who have won judgements against Pennsylvania licensees as a result of willful deceit, material misrepresentation of facts, or fraud in a real estate transaction.

What is the best way to describe the real estate recovery fund clause in a Pennsylvania sales contract?

“A Real Estate Recovery Fund exists to reimburse any person who has obtained a final civil judgment against a Pennsylvania real estate licensee owing to fraud, misrepresentation, or deceit in a real estate transaction and who has been unable to collect the judgment after exhausting all legal and equitable remedies.

What is the limit on the amount that plaintiffs can collect from the real estate Recovery fund in Arizona?

1. Thirty thousand dollars for each transaction, regardless of the number of persons aggrieved or the number of licensees or parcels of real estate involved. 2. Ninety thousand dollars for each licensee.

What to do if Social Security is not enough to live on?

Has your income declined or have you experienced a loss of financial resources? You may be able to get additional income through the Supplemental Security Income program, which helps seniors and the disabled who have limited income and financial resources.

Will living with someone affect my benefits?

Frequently Asked Questions

What is the 5 year rule for Social Security disability?

Does rent affect Social Security?

How much of Social Security counts as income?

What is the maximum amount that the FREC will pay from the recovery fund for one transaction is $150000?

The maximum amount that can be claimed from Florida's Real Estate Recovery Fund is $50,000 per single transaction. An injured party can claim a maximum of $150,000 for multiple transactions; they can claim the unsatisfied portion of a judgment, whichever amount is less.

Does rental income affect SSI?

Rental income you receive from real estate does not count for Social Security purposes unless: You receive rental income in the course of your trade or business as a real estate dealer (see §§1214-1215);

What is the $5 000 Social Security loan?

These loans allow eligible individuals to borrow against their future Social Security benefits, providing a lifeline during times of need. Among the various Social Security loan options, the $5,000 loan stands out as a valuable resource for those in immediate need of funds.

FAQ

- Does rental income affect SSDI?

Rental income is typically considered passive, so it shouldn't affect your eligibility to receive SSDI benefits. But if you perform work, like renovations or maintenance, on the rental property, then any income you receive may be considered earned and count against you.

- Does owning rental property affect Social Security benefits?

Rental income you receive from real estate does not count for Social Security purposes unless: You receive rental income in the course of your trade or business as a real estate dealer (see §§1214-1215);

- How much money can you make on disability without losing it?

The earning limits for Social Security Disability Insurance (SSDI) benefit recipients have increased for 2023. The current limit is $2,460 per month for blind individuals and $1,470 for non-blind individuals. Recipients must also be aware of the monthly income amounts that might trigger a trial work period (TWP).

- What income reduces Social Security disability benefits?

Each month, we reduce your SSI benefits 50 cents for every dollar that you earn over $85. Example: You work and earn $1,000 in a month; and your only income comes from your earnings and your SSI.

- Can I make money while on disability?

- If you receive Supplemental Security Income (SSI) and/or Social Security Disability Insurance (SSDI), you may be able to work while keeping your benefits. But the benefit amount you receive may be reduced depending on how much money you earn from your job.

- What is the SSI home exclusion?

The home exclusion means that you won't lose your SSI if you buy a house. To be eligible for the SSI home exclusion, you must own your home. To qualify, you can own the house in a number of ways: Find out if you qualify for SSDI benefits.

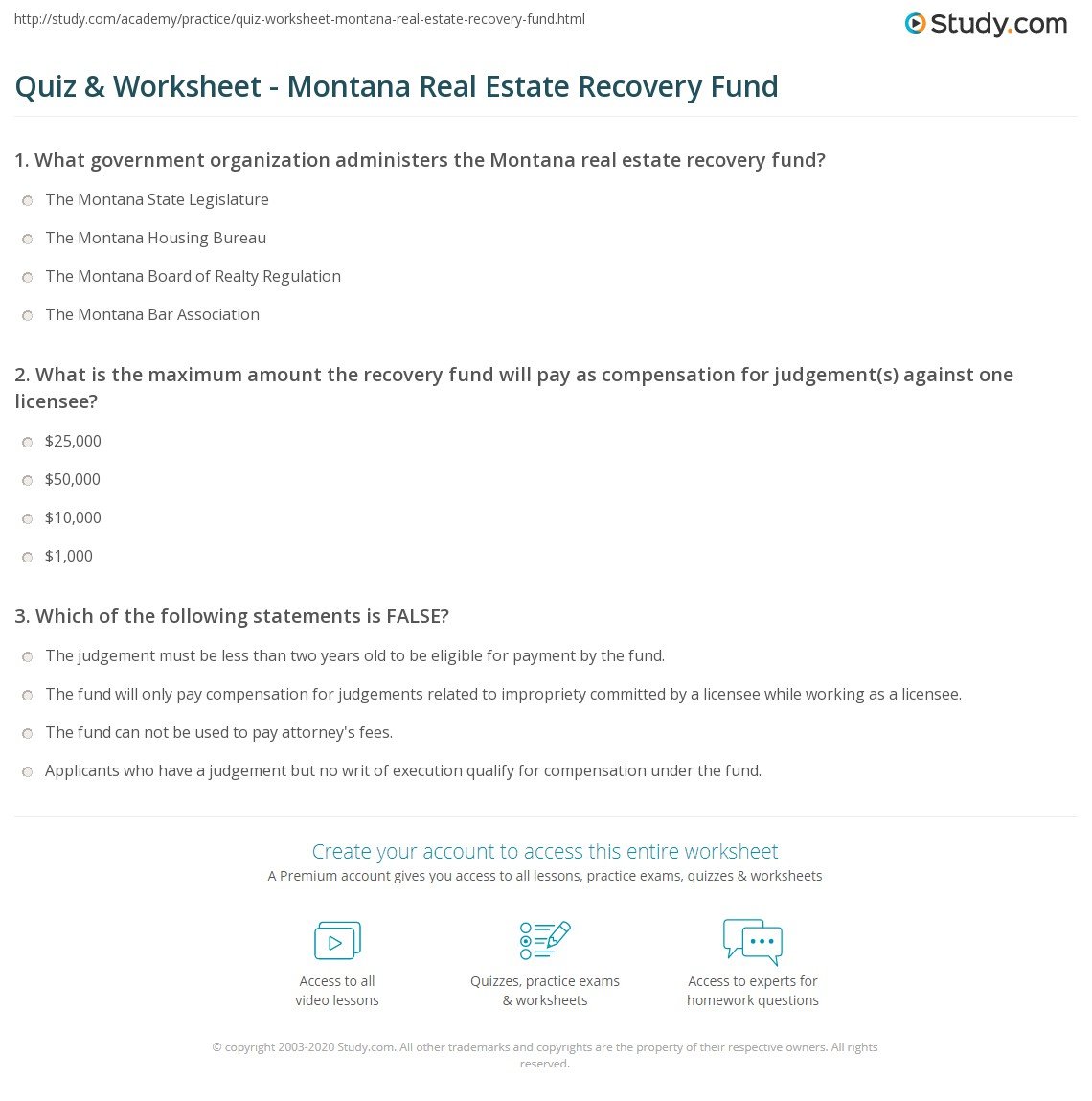

What is the maximum compensation that can be paid from the real estate recovery fund in pa

| What can reduce SSI benefits? | In-kind support and maintenance is food, shelter, or both that somebody else provides for you. We count in-kind support and maintenance as income when we figure the amount of your SSI. For example, if someone helps pay for your rent, mortgage, food, or utilities, we reduce the amount of your SSI. |

| What does SSI consider household expenses? | Household operating expenses are the household's total monthly expenditures for food, rent, mortgage, property taxes, heating fuel, gas, electricity, water, sewerage, and garbage collection service. (The term does not include the cost of these items if someone outside the household pays for them.) |

| What types of income does not affect Social Security benefits? | We include bonuses, commissions, and vacation pay. We don't count pensions, annuities, investment income, interest, veterans benefits, or other government or military retirement benefits. |

| Can I take my PA real estate exam online? | Test with confidence and convenience. Take your exam online, on your schedule, from your own home. |

| What is the best way to study for the PA real estate exam? | Take a Pennsylvania Real Estate Practice Test, or Two or Three. One thing you can't do enough of is taking practice tests. Researchers that know a thing or two about studying have concluded that practice tests are the best tool for exam prep. There are three major benefits associated with using practice tests. |

| How do I schedule PA real estate exam? | How Exams are Scheduled. Register directly with Pearson Vue services online at https://home.pearsonvue.com/pa/realestate or by telephone at 888-511-5352. Download and refer to Pearson Vue's Candidate information Bulletin for details. |

- How many questions is the PA state real estate exam?

Pennsylvania Real Estate Exam Questions

The Pennsylvania real estate salesperson exam has 120 questions. There are 80 questions on the national portion and 40 questions on the state portion.

- Is PA real estate exam hard?

Is the Pennsylvania real estate exam hard? A passing score is never guaranteed, and very few students report the exam experience as “easy.” However, with the right amount of hard work and preparation, you can alleviate your nerves and dramatically up your chances of success.

- How much will SSI be in 2024?

SSI amounts for 2024

Recipient Unrounded annual amounts for— 2023 2024 a Eligible individual $10,970.44 $11,321.49 Eligible couple 16,453.84 16,980.36 Essential person 5,497.80 5,673.73

- Who rent a house while on ssi disability

Dec 18, 2021 — Thus, for example, a disabled individual receiving SSDI benefits can legally own personal and rental property and earn revenue through rent

- Where can i rent a house while on ssi disability

If you live in your own place, regardless of whether you own or rent, you may get up to the maximum SSI benefit amount payable in your State.

Recent Comments