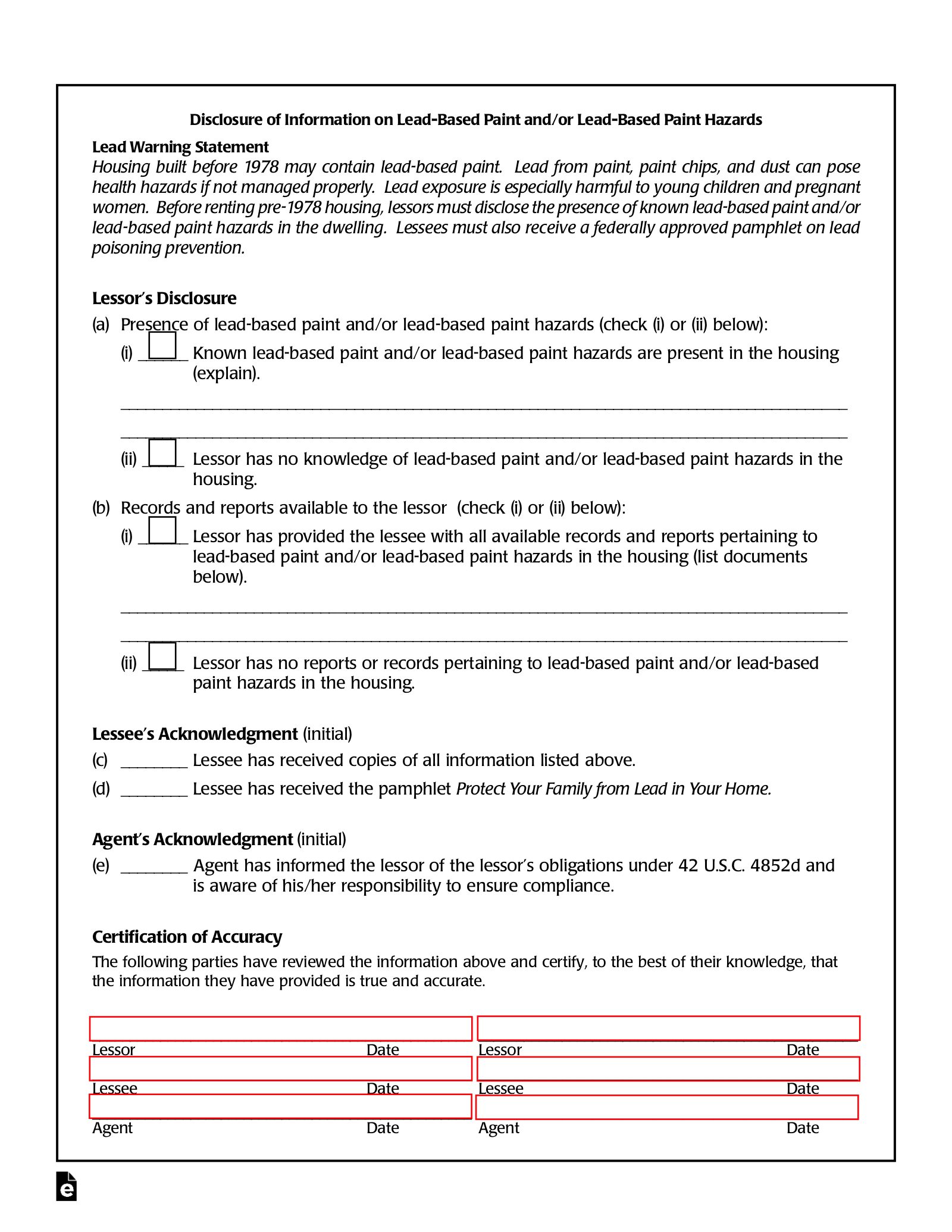

Section 1018 of this law directed HUD and EPA to require the disclosure of known information on lead-based paint and lead-based paint hazards before the sale or lease of most housing built before 1978.

Who is required to disclose the known use of lead-based paint to buyers of property built before 1978?

Landlords must give prospective tenants of target housing, including most buildings built before 1978: An EPA-approved information pamphlet on identifying and controlling lead-based paint hazards, Protect Your Family From Lead In Your Home (PDF).

What happens if they find lead paint in your house?

Lead Paint Risks

Lead can cause damage to the brain and other vital organs, as well as behavioral problems, learning disabilities, seizures, and even death. Young children and pregnant women, in particular, are at risk, but people (and animals) of any age can experience lead-caused health problems.Which of these is required in a lead-based paint disclosure for home built prior to 1978?

What must a lead paint disclosure include? The disclosure form should summarize the federal law (the Residential Lead-Based Paint Hazard Reduction Act of 1992) that created the requirement, notifying the tenant that homes built prior to 1978 typically used lead-based paints and that they pose a health risk if ingested.

Do all homes built before 1978 have lead paint?

How do you write a seller finance offer?

Be Prepared to Propose Seller Financing

You could say, for example, "My offer is full price with 20% down, seller financing for $350,000 at 6%, amortized over 30 years with a five-year balloon loan. If I don't refinance in two to three years, I will increase the rate to 7% in years four and five."

What does owner will carry the note mean?

“Seller/Owner Will Carry” or “Seller/Owner Financing” is when the owner of the property is financing the loan for the buyer to purchase the property. This means the current owner of the home owes no money on the property and becomes the lender for the home's buyer.

Frequently Asked Questions

How do you write a proposal for owner financing?

Key takeaways

An owner financing agreement includes purchase price, down payment, loan balance, interest rate, payment schedule, and starting and end dates. Make sure to include closing costs, late fee treatments, taxes and insurance responsibilities, and treatment in case of default.

What is the best asset class in real estate?

For example, consider investing in B- or C-class properties if you're looking to achieve strong cash flow. However, if you're looking to invest in high-end neighborhoods and work with high-end tenants, you'll want to look at Class A properties. That said, it's essential to diversify your rental portfolio.

What are the highest yielding real estate asset classes?

Different assets classes have different average rates of return. At the current time, the highest-yielding forms of commercial real estate are mobile home parks, self-storage facilities, billboards and RV parks.

What does C mean in real estate?

What are the property asset classification?

Like shares, property (real estate) is often considered a growth asset class, offering the potential for higher returns on both capital growth and income. You can invest in property without buying a whole house.

What are the two asset classes real estate?

The real estate asset class, on the other hand, is broken down into two main property types: commercial and residential.

What does AC stand for in commercial real estate?

What Do These Abbreviations Mean in Real Estate?

| Abbreviation | Definition |

|---|---|

| A/C | Air Conditioning |

| ACTV | Active |

| ALM | Aluminum Siding |

| APT | Apartment |

What is the loan made by the seller called?

A seller financing agreement functions along similar lines as a mortgage loan, except that it allows the home seller to own and oversee the debt instead of a traditional lender. Seller financing is also referred to as owner financing or purchase-money mortgages.

What is a seller-financed transaction?

Seller financing, also referred to as owner financing, is an arrangement where the seller of a property acts as the lender instead of a bank or another financial institution. Buyers make payments directly to the seller, effectively cutting out any intermediary.

What are the two types of seller financing?

Here's a quick look at some of the most common types of seller financing. All-inclusive mortgage. In an all-inclusive mortgage or all-inclusive trust deed (AITD), the seller carries the promissory note and mortgage for the entire balance of the home price, less any down payment. Junior mortgage.

What is it called when the buyer borrows from the seller in addition to the lender?

What is a loan made by a sellers part of the purchase transaction?

Is real estate space market segmented?

Within each sub-market or segment, the same good may have a different equilibrium price. The real estate space market is highly segmented.

FAQ

- What is a space market in real estate?

Real Estate Space Market. The term “space market” is the market for the usage of real property. In this market, tenants exchange rent with landlords for the right to use land and built space. This market is often called “the rental market.”

- How is the real estate market categorized?

Classification of Real Estate: How It Works

Most investors know that real estate is classified into three types of markets: primary, secondary, and tertiary. In addition, each market is separated by job growth, population, and demographics.

- What is the difference between a real estate space market and the real estate asset market group of answer choices?

- The real estate space market deals with physical capital. The real estate asset market deals with financial capital. "Physical Capital” = Real physical assets that produce real goods or services over an extended period of time.

- What are the different types of segments in real estate?

The main segments of the real estate sector are residential real estate, commercial real estate, and industrial real estate.

- What expense category is a restaurant?

Major categories of restaurant expenses

Beginning at the top, we have Sales, Cost of Goods, Labor Expenses, Direct Operating Costs, Advertising & Promotion, General & Admin, Maintenance Cost, and Occupancy.

- What are the food groups of commercial real estate?

The “four basic food groups” in real estate are generally viewed as office, industrial, retail and multifamily. Each real estate property type (in the industry referred to as 'asset classes') can be further divided into sub-categories. For example, there are more than a half dozen types of retail investment properties.

- What is an example of a restaurant asset?

A restaurant asset is any tangible or intangible property that can be used to generate income for a restaurant. These assets may include the physical building, equipment, furnishings, signage, menus, recipes, and customer lists.

- Is restaurant equipment a fixed asset?

- Tangible fixed assets include property, furniture, fixtures, equipment, and infrastructure. Intangible fixed assets include the restaurant's brand, reputation, intellectual property rights, and proprietary software.

- What category is a business dinner?

- Entertainment. In many countries, business meals are considered a type of 'entertainment', and can be expensed under this category. This is often the case in the United States, where business meals are considered a deductible business expense if they meet certain criteria.

- Who is responsible for making sure a seller complies with the EPA lead-based paint disclosure obligations?

In addition, the agent is responsible, along with the seller or lessor, if the seller or lessor fails to comply; unless the failure involves specific lead-based paint or lead-based paint hazard information that the seller or lessor did not disclose to the agent. Read the regulations that includes these requiremenRts.

- Whose obligation is it to disclose potential lead-based paint to buyers?

- The seller or landlord must also disclose information such as the location of the lead-based paint and/or lead-based paint hazards, and the condition of the painted surfaces.

- When must a seller complete a disclosure and Acknowledgement of lead-based paint for properties built before?

Lead Warning Statement

Every purchaser of any interest in residential real property on which a residential dwelling was built prior to 1978 is notified that such property may present exposure to lead from lead-based paint that may place young children at risk of developing lead poisoning.

- What is a property managers responsibility regarding lead-based paint disclosure quizlet?

Owners and managers of older residential rental properties must. avoid chipping and peeling paint---Construction prior to 1978 must provide a disclosure statement describing the potential hazard of lead paint. Managers must make a lead-based paint disclosure when the property they manage was built before. 1978---

What is a lead paint disclosure on a home sale

| What are the 5 main categories of real estate? | Real estate is considered real property that includes land and anything permanently attached to it or built on it, whether natural or man-made. There are five main categories of real estate which include residential, commercial, industrial, raw land, and special use. |

| What are the three classifications of property? | Property law in the United States is complex and multifaceted, but these laws pertain specifically to three distinct types of property. Both state and federal laws exist to protect real property, personal property, and intellectual property. |

| What are properties classes? | Property classes refer to a property classification system used to determine the potential of an investment property based on a combination of geographic, demographic, and physical characteristics. It is important to note that the difference in each property class is relative to the market it is in. |

| What are the 6 types of property? | Table of Contents

|

| What does Class A mean in real estate? | The highest-quality buildings Class A includes the highest-quality buildings on the market, although these standards and thresholds can vary by city. These buildings are typically built within the last 15 years, as property classifications change over time. |

| What are the 5 types of property? | There are five main categories of real estate which include residential, commercial, industrial, raw land, and special use. Investing in real estate includes purchasing a home, rental property, or land. Indirect investment in real estate can be made via REITs or through pooled real estate investment. |

| What determines the class of a property? | Classes of Property, Defined Real estate properties are categorized into different classes based on their age, location, physical condition, and potential for generating income. The most common classification is Class A, B, and C properties, each representing a different level of quality and risk. |

| What does ABC mean in real estate? | Many investors define the asset class purely by the age of the home: Class A: Homes built in the last 10 years. Class B: Homes built in the last 10-20 years. Class C: Homes built in the last 20-30 years. |

| What does Class C in a house mean? | What is a Class C property? A Class C property is one that is older (typically 30+ years old), in fair to poor condition, and typically not as well-located as a Class A or Class B building. They are considered to be the “riskiest” investment, but in turn, offer some of the best potential cash-on-cash returns. |

| What does C grade mean in real estate? | C Quality Dwellings. These homes are designed and built by contractors who specialize in average quality construction. Adequate detail is given to ornamentation with the use of average grade materials and typical workmanship. |

| What are Class C units? | Class C Unit means a Unit representing a fractional part of the Member Interests of the Members and having the rights and obligations specified with respect to the Class C Units in this Agreement. |

| What is a class property? | Property classes refer to a property classification system used to determine the potential of an investment property based on a combination of geographic, demographic, and physical characteristics. It is important to note that the difference in each property class is relative to the market it is in. |

| How do you classify property? | The three most common real estate property types are residential, commercial, and land.

|

- Are there four categories of property?

- The four types of intellectual property are:

- Copyrights.

- Trademarks.

- Patents.

- Trade Secrets.

- The four types of intellectual property are:

- What are the 7 types of properties?

- To Begin With, Firstly, Remember These Major Types Of Property:

- Movable property and Immovable property.

- Tangible property and Intangible property.

- Private property and Public property.

- Personal property and Real property.

- Corporeal property Incorporeal property.

- To Begin With, Firstly, Remember These Major Types Of Property:

- Who is the owner of the contract?

In business, the term “contract ownership” refers to the legal right to enter into and enforce a contract. This right is typically held by the party who stands to benefit from the contract's performance.

- What does it mean when a seller will carry?

“Seller/Owner Will Carry” or “Seller/Owner Financing” is when the owner of the property is financing the loan for the buyer to purchase the property. This means the current owner of the home owes no money on the property and becomes the lender for the home's buyer.

- Why would someone offer owner financing?

Owner financing can expedite the sale process, eliminating the need for the buyer to go through the lengthy mortgage approval process, which is particularly advantageous in competitive real estate markets.

- What are the risks of owner financing?

The chief drawback for buyers lies in the higher interest incurred, and the shorter amount of time to pay the loan off. “The interest rate charged by a seller is usually much higher than a traditional mortgage lender would charge,” says McDermott.

- What does it mean to be the owner of a contract?

Contract Ownership is the act of being responsible for something, such as a Contract, an Event, an Obligation or mitigation of a Risk. Contract management software allows you to assign different contract ownership to your contracts, such as a IT Owner or Legal Owner.

- What are property assets called?

Property, plant, and equipment assets are also called fixed assets, which are long-term physical assets. Industries that are considered capital-intensive have a significant amount of fixed assets, such as oil companies, auto manufacturers, and steel companies.

- Is real estate an asset or liability?

- Your home falls in the asset category even if you have not paid it entirely off. The value assigned to your home can be the amount you paid to purchase it, the taxable value or the current market value based on how other houses are selling in your neighborhood.

- Is real estate a wealth asset?

As you pay down a property mortgage, you build equity—an asset that's part of your net worth. And as you build equity, you have the leverage to buy more properties and increase cash flow and wealth even more.

- What is the difference between an asset and a property?

- Property is anything that can be owned, such as a house or claims to a resource (which includes land). In contrast, an asset is anything worth something. Unlike property, assets don't have to be tangible objects that you physically own. For example, stocks and bonds are considered assets.

- Why your home is not an asset?

“Using this simple and practical definition, your home is a liability because it takes money out of your pocket each month in the form of a mortgage, taxes, insurance, and maintenance costs. It does not put money in your pocket. Only if you're able to sell it at a profit does it become an asset.

Recent Comments