What is a listing agreement between a real estate brokerage firm and a seller called?

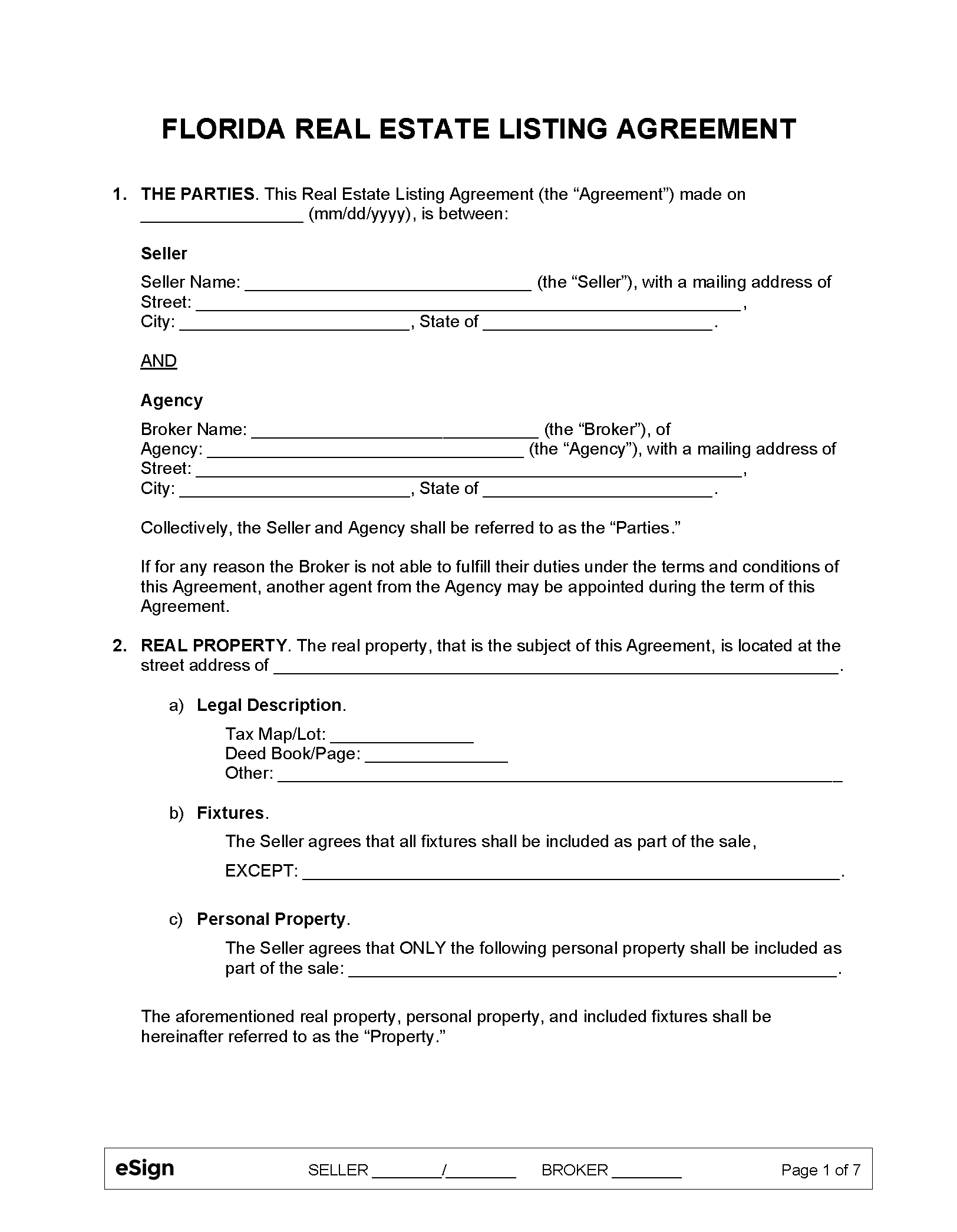

A real estate listing agreement – also known as a seller's agent agreement – is a contract between a property owner and a real estate broker. It permits the broker to sell the home on the seller's terms, locating an appropriate buyer. The property owner pays the brokerage a commission for acting as the listing agent.

What is a written contract between a buyer and a broker called?

Sellers sign a similar contract, known as a listing agreement, with their listing agent. Buyer's agency agreements are also known as buyer-broker agreements. Written agreements can clarify the relationship between the two parties.

What is the actual contract between the buyer and the seller called?

Is a buyer broker agreement required in Florida?

Can a seller cancel a listing agreement in Florida?

Canceling a listing agreement

If a seller decides to cancel a listing agreement such as an Exclusive Right of Sale Listing Agreement before its termination date, it is up to the broker to let the seller out of the agreement. There is no unilateral right to terminate the Exclusive Right of Sale Listing Agreement.

Can an estate agent charge a withdrawal fee?

Frequently Asked Questions

How do you terminate a listing agreement in Florida?

There are three surefire ways to terminate a listing agreement ing to real property law — death, insanity, or bankruptcy of either the broker or the seller. Depending on the contract, someone who has power of attorney for the seller may be able to continue the sale of the home.

What are the disadvantages of putting your house in trust?

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Why do rich people use trust funds?

Despite what you might think, trusts aren't only for the rich. Anyone can use them to grow their wealth, protect their assets, avoid certain taxes, shelter money from lawsuits and streamline the transfer of their estate to their heirs.

What makes a listing agreement legally binding?

Yes, a listing agreement is a legal contract that is legally binding. Most states require a listing agreement be put into writing when a real estate agent agrees to represent property owners in order for the contract to be enforceable.

FAQ

- Who are the parties to a listing agreement?

A listing agreement is a legally binding contract between you — the homeowner — and the real estate broker (and agent) you hire to sell your property. It's a contract that outlines the realtor-seller relationship during a real estate transaction.

- Who or what may terminate a listing agreement?

There are three surefire ways to terminate a listing agreement according to real property law — death, insanity, or bankruptcy of either the broker or the seller.

- What are the disadvantages of putting your house in a trust?

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

- What is the best trust to have?

An irrevocable trust offers your assets the most protection from creditors and lawsuits. Assets in an irrevocable trust aren't considered personal property. This means they're not included when the IRS values your estate to determine if taxes are owed.

What is a agreement in florida real estate called when seller and broker ?

| At what net worth should you consider a trust? | $100,000 On the other hand, a good rule of thumb is to consider a revocable living trust if your net worth is at least $100,000. Even so, be sure to check your state's “small estate” laws—which set dollar amounts or caps for a decedent's estate—knowing that anything below these thresholds may allow you to bypass probate. |

| What are the advantages of a trust in real estate? | However, depending on the type of trust you choose, it can have its advantages. Those may include greater control of what happens to the home after your death, the minimization of estate taxes, and protection from financial liability in the event of a lawsuit. |

| Why should I put my investments in a trust? | There are several benefits of creating a trust. The chief advantage is to avoid probate. Placing your important assets in a trust can offer you the peace of mind of knowing assets will be passed on to the beneficiary you designate, under the conditions you choose and without first undergoing a drawn-out legal process. |

| What are the pros and cons of real estate trusts? | Real estate investment trusts reduce the barrier to entry for investors in the real estate market and provide liquidity, regular income and other perks. However, you'll be exposed to risks that aren't inherent in the stock market and dividends are subject to ordinary income tax. |

- Why would you want to create a trust?

For example, you can use a trust to transfer property, help minimize estate taxes, preserve assets for minors until they are adults, or benefit a charity. And while trusts have a reputation for being expensive, some attorneys offer a basic trust package for a flat fee.

- What are the pros and cons of owning real estate in a trust?

- What Are the Advantages & Disadvantages of Putting a House in a Trust?

- Protection Against Future Incapacity.

- It May Save Money on Estate Taxes.

- It Can Avoid Probate.

- Asset Protection.

- Trusts Can Cost More to Maintain.

- Your Other Assets Are Still Subject to Probate.

- Trusts Are Complex.

- What Are the Advantages & Disadvantages of Putting a House in a Trust?

- What are the disadvantages of putting your house in a living trust?

- Most people think the benefits outweigh the drawbacks, but before you make a living trust, you should be aware of them.

- Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.

- Record Keeping.

- Transfer Taxes.

- Difficulty Refinancing Trust Property.

- No Cutoff of Creditors' Claims.

- Most people think the benefits outweigh the drawbacks, but before you make a living trust, you should be aware of them.

- Are real estate trusts worth it?

Real estate investment trusts (REITs) are a key consideration when constructing any equity or fixed-income portfolio. They can provide added diversification, potentially higher total returns, and/or lower overall risk.

Recent Comments