- Advertising.

- Business Travel.

- Meals and Entertainment.

- Commissions.

- Communication.

- Contract Labor.

- Legal and Professional Fees.

- Insurance Payments.

What type of business expense is a camera?

Equipment you'll use for more than a year—including cameras, lenses, lighting, light boxes, filters, tripods, computers, and hard drives—counts as capital expenses.

Is a photoshoot a business expense?

How do photographers write off business expenses?

- 📷 Camera & equipment.

- 💻 Photo editing software.

- 🔑 Photo studio.

- 📓 Photography classes.

- 🎭 Photoshoot props.

- Schedule C, Box 11. If you need to hire an editor, designer, photographer, or other creative pro, write off what you pay them.

- 🌐 Website & hosting fees.

- 📣 Online advertising.

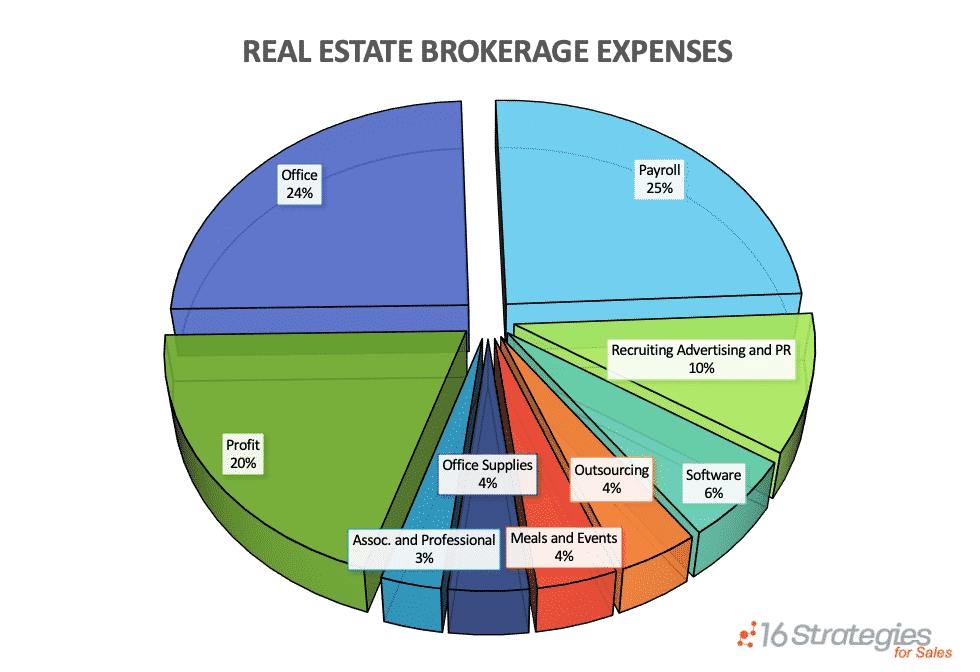

How do you categorize business expenses?

Business expenses can be categorized into various buckets including payroll, employee benefits, general and administrative expenses, marketing and advertising, research and development, and payments for professional services.

What does tax deductible mean in real estate?

Deductible Real Estate Taxes. You can deduct real estate taxes imposed on you. You must have paid them either at settlement or closing, or to a taxing authority (either directly or through an escrow account) during the year.

President @realDonaldTrump's plan: better care, with more choice, at a lower price point 🇺🇸 pic.twitter.com/MfC5E4iH9g

— The White House 45 Archived (@WhiteHouse45) September 24, 2020

What are deductible estate administration expenses?

Attorneys' fees, including attorneys' fees in contesting a deficiency or prosecuting a claim for refund. Court costs, surrogates' fees, accountants' fees, appraisers' fees, etc. Cost of storing or maintaining property. Brokerage fees for selling property of the estate.

Frequently Asked Questions

How do deductibles work for taxes?

A deductible for taxes is an expense that a taxpayer or business can subtract from adjusted gross income, which reduces their taxable income, thereby reducing the amount of taxes owed.

How many miles do realtors write off?

Although it greatly depends on the average miles driven per year, the annual business mileage for a realtor is around 7,000 – 10,000 miles a year. This means a tax deduction of several $1,000s on average.

Are closing gifts tax deductible?

That's right, you can get your client a luxury gift to remember you by just so you can owe less in taxes by the end of the year. A client gift can be considered an "ordinary expense" because it's a standard way to market your business. Here's the catch: only $25 per client gift is tax deductible.

What if my rental property expenses are more than my income?

When your rental property expenses are more than income, you usually can't claim the loss since rental activities are passive activities. However, you can claim all or a portion of the loss if an exception to the passive activity loss rule applies. You can use passive losses to offset passive gains.

What is the IRS deduction for real estate taxes?

The deduction for state and local taxes, including real estate taxes, is limited to $10,000 ($5,000 if married filing separately). See the Instructions for Schedule A (Form 1040) for more information.

What are considered selling expenses in real estate?

Costs associated with selling a home include real estate agent commissions and potential tax on profits. Sellers typically pay real estate agent commissions must to both their agent and the buyer's agent. Preparing a home to show to buyers can entail several expenses, such as repainting or new landscaping.

What is the rule of thumb for rental property expenses?

The 50% rule in real estate says that investors should expect a property's operating expenses to be roughly 50% of its gross income. This is useful for estimating potential cash flow from a rental property, but it's not always foolproof.

FAQ

- Can you write off commissions on your taxes?

Commissions paid by your business to employees, real estate agents and contractors, to name a few, are generally fully deductible business expenses that no entrepreneur should overlook. Depending on your business, commissions can quickly add up and end up being one of your largest deductions.

- What can you deduct from the sale of a house?

Deduction number one: You can write off mortgage interest from the year of the purchase to the year of the sale or until the mortgage is paid off. Number two: You may deduct loan origination fees, loan discounts, discounted points or maximum loan charges in some cases.

- What tax deductions can I claim for buying a house?

- 8 Tax Breaks For Homeowners

- Mortgage Interest. If you have a mortgage on your home, you can take advantage of the mortgage interest deduction.

- Home Equity Loan Interest.

- Discount Points.

- Property Taxes.

- Necessary Home Improvements.

- Home Office Expenses.

- Mortgage Insurance.

- Capital Gains.

- Are staging costs tax-deductible?

The costs of staging are subtracted from the proceeds of the sale of the home and decrease the total realized profit. In summary, the IRS's position is that Staging costs are a legitimate selling expense for both primary and secondary homes and are therefore tax deductible.

- Is commission allowed an expense?

Commissions are compensation for obtaining sales. Hence, sales commissions are a selling expense and will be recorded in general ledger accounts having Sales Commissions Expenses in their title.

- Can I deduct my commission fees?

You typically pay a commission when you buy, and you pay another commission when you sell. The IRS does not consider investment commissions to be a tax-deductible expense. Instead, the commission becomes part of the investment's cost basis, which still provides you with some tax relief.

What expense category does real estate photography fall under

| Is real estate commission an expense? | FAQ about real estate commissions Real estate agents get paid from a percentage of a home sale, typically at a rate of 2-3% each for the buyer's and seller's agents. That means on a traditional home sale, 4-6% of the home sale price goes to agent fees. This expense is part of seller's closing costs. |

| Can I claim brokerage fees on my taxes? | Mutual fund management fees are tax deductible in non-registered accounts, but commissions or trading fees to buy stocks and other investments are not tax deductible. |

| Can realtors write off commission splits? | Are broker fees tax deductible? Unless you're at a 100% commission split, you're paying some form of broker or desk fees to your real estate firm, and those can be tax deductible. Just be very careful about writing off desk fees from your brokerage AND a home office deduction, which can be a red flag for the IRS. |

| What percentage of car payment can I write off? | For instance, if you use the vehicle 50 percent of the time for business reasons, you can only deduct 50 percent of the loan interest on your tax returns. If you pay $1,000 in interest on your car loan annually, you can only claim a $500 deduction. |

| Can a realtor depreciate a vehicle? | Small business owners, including real estate agents, have two methods available for deducting their auto use: The Standard Mileage Rate and the Actual Cost Method. Those who use the actual cost method are required to depreciate their vehicles. |

| Can real estate agents write off haircuts? | Real estate agents are eligible for a wide variety of tax deductions. Expenses such as client entertainment, personal wardrobe, and haircuts aren't deductible. |

- What is Section 179 for real estate agents?

The 179 Expense allows business owners to deduct a desired amount of a qualified asset's value in the year it is placed in service. Unlike Bonus Depreciation, the Section 179 Expense is not mandatory. The taxpayer elects the amount of the asset's value they wish to expense.

- What is the 20 percent car payment rule?

The 20/4/10 rule encourages consumers to put down at least 20% of the total price of their vehicle, which will lower the overall amount you borrow and reduce the interest you'll pay over the life of the loan. While there are no-money-down car loans, not providing a down payment can cost you more in the long run.

- Can I deduct a car purchase on my taxes?

Hear this out loudPauseYou technically can't write off the entire purchase of a new vehicle. However, you can deduct some of the cost from your gross income. There are also plenty of other expenses you can deduct to lower your tax bill, like vehicle sales tax and other car expenses.

- Can real estate agents use Section 179?

Hear this out loudPauseMost assets purchased by real estate agents qualify for the Section 179 Expense. Machinery, equipment, and furniture used in business. Off-the-shelf computer software. Assets used in residential rentals such as beds, furniture, and appliance.

- Can you write off a car purchase for 1099?

Hear this out loudPauseYou have two options when it comes to this 1099 deduction: Your actual car expenses, like the cost of gas, maintenance, insurance, car payments, and depreciation, or. A standard amount for every mile you drive.

- Can I buy a car as a business expense?

Hear this out loudPauseThe most significant financial reason to purchase a vehicle through your company is the reduction in your business tax liability. The costs of operating your vehicle are tax-deductible when it's used for your business. But only the costs of operating a company vehicle for business trips can be deducted.

Recent Comments