As a note buyer, you effectively lend the property owner money. In return for this loan, the homeowner pays you interest. The amount of interest you earn is typically higher than what you would earn from a traditional savings account or certificate of deposit.

How do I sell real estate notes?

- Gather all of the details on the mortgage note you want to sell.

- Provide the details to the buying entity for a free quote.

- Decide if the amount offered is right for you and proceed with the sale.

- The buying company will perform the diligence and underwriting process.

How do you flip real estate notes?

Flipping notes is simply buying a real estate note and then later selling it. There are a variety of ways to make money with this strategy including buying a note at a discount and then reselling it. Or you might buy a note and then sell only a portion of the note.

Is note investing profitable?

While it is one of the least common types of real estate investing, there are a lot of pros to it. Note investing has the potential to give you a desirable return on investment (ROI). One of the ways you make a good ROI is by buying these non-performing assets and getting the payments back on track.

How to make $1000000 a year in real estate?

If You're Going to Dream, Dream Big (and Plan Even Bigger) Consider what it would take to make $1 million in gross commissions your first year selling real estate (before expenses and taxes). It would involve selling approximately $50 million of real property with an average salesperson commission of 2%.

What are the factors affecting real estate market value?

Market value is determined by the valuations or multiples accorded by investors to companies, such as price-to-sales, price-to-earnings, enterprise value-to-EBITDA, and so on. The higher the valuations, the greater the market value.

3 tips for Borrowing Fr Friends & Family to Invest in Real Estate.

— Nicole Purvy (@nicolepurvy) March 17, 2021

1-Pay monthly interest-only pmts-yr lender will feel secure

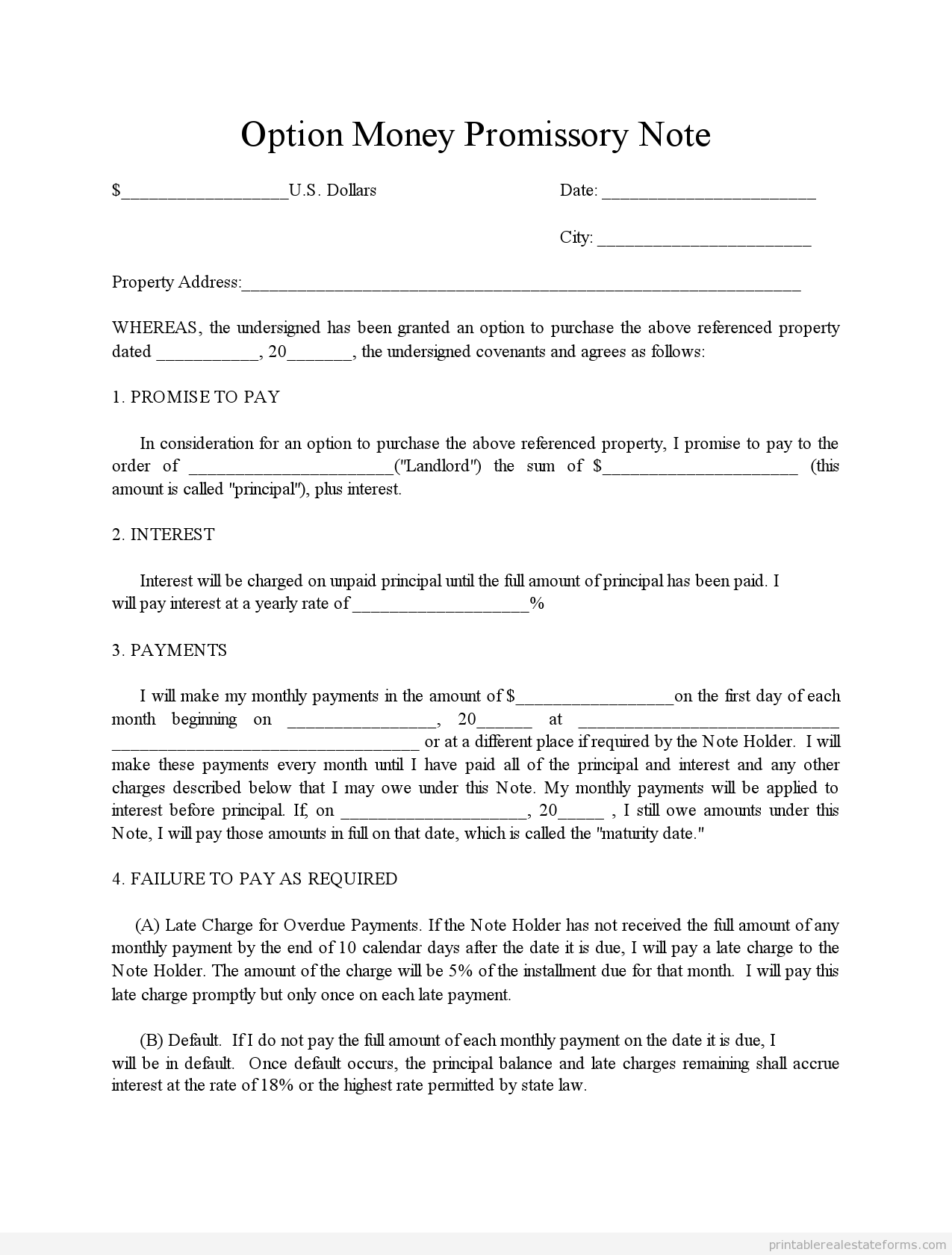

2-Sign a promissory note

3-Borrow the total amt PLUS interest pmts so yr lender is paying their own interest(if you need 20k & pay 10% int, borrow 22k)

How do you value real estate notes?

Frequently Asked Questions

What causes property value to increase?

As demand for property goes up, prices tend to go up. As demand decreases, so do prices. An individual property can also change in value due to changes to the property itself. If something is added, such as a garage, bedroom, or pool, the value increases.

Is 30k enough to live in NYC?

Do you have to make 3x rent in NYC?

A widely accepted guideline in expensive cities – like Los Angeles, New York, and Chicago – is that your monthly rent shouldn't be more than a third of your monthly salary. For example, if you make $2,400 a month, the apartment should be at most $800.

What income do you need to rent in NYC?

In NYC, most landlords require that the tenant's annual salary be greater than 40 times the monthly rent. This means that a tenant eyeing a $1,500 a month apartment would have to gross $60,000 a year in order to qualify, resulting in a maximum rent-to-income ratio of 30%.

FAQ

- What percentage of salary do New Yorkers pay in rent?

Residents in some cities are more rent burdened than others. In New York, for example, the rent-to-income ratio in 2022 was 68.5 percent, the Moody's report found.

- How much of salary do New Yorkers spend on rent?

Residents in some cities are more rent burdened than others. In New York, for example, the rent-to-income ratio in 2022 was 68.5 percent, the Moody's report found.

- How much of income should go to rent NYC?

30%

The dictates of the 30% rule suggest that you budget 30 percent of your monthly income to house rents. So with this rule, the quality of the living space that you can rent will be dependent on the income that you make.

- How much rent can I afford on 100k in NYC?

Rent Calculator NYC

Gross Yearly Income Max Monthly Rent $90,000 $2,250 $100,000 $2,500 $125,000 $3,125 $150,000 $3,750

How to pay off a real estate note

| What income do you need for an apartment in NYC? | Many landlords require a prospective tenant's gross annual income to be 40-times the monthly rent. This means that an apartment priced at $1,500 a month would require the tenant to make $60,000 a year before taxes, giving them a rent-to-income ratio of 30%. |

| Is 150k a good salary in NYC? | In New York City, a $150,000 salary feels like $54,000 For many, earning a salary topping $US100,000 ($151,000) feels like a mark of success — but how far it goes depends on where you live. In New York City, that annual paycheck is worth just $US36,000, after taxes and accounting for the steep cost of living. |

| How does a note work in real estate? | Real estate notes are created when a property buyer finances the purchase of their property through a mortgage loan. The mortgage note is then sold to an investor, and the proceeds from the sale are used to fund the loan. The investor becomes the lender, and the property owner becomes the borrower. |

| What happens when a mortgage note is paid off? | The promissory note is a negotiable instrument. The person or company that holds that note has the right to collect the payments due on the note. For this reason, the lender would typically return the note and mortgage and stamp them “canceled” once the homeowner paid off the loan. |

- How do you get out of a promissory note?

Circumstances for release of a promissory note

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

- What is the process of paying off a mortgage?

The mortgage company will send you a letter with a payoff amount through a specific date. This amount includes accrued interest through a certain date. Pay the amount due by the due date or expiration of the payoff statement to eliminate your mortgage. Any excess amount that you pay will be refunded.

- What applies to a note in real estate?

The note details the loan value, the interest rate charged by the lender, the due dates for payments, and the loan terms. 1. The mortgage portion is the document that gives the mortgage provider the right to take the property if the borrower fails to pay the mortgage under the loan terms.

- How much apartment can i afford to rent nyc

Our calculator will tell you how much you should spend on rent based on expert advice. Annual income before taxes. Low Range. -15% of income

Recent Comments